Group Discussion – learning lessons

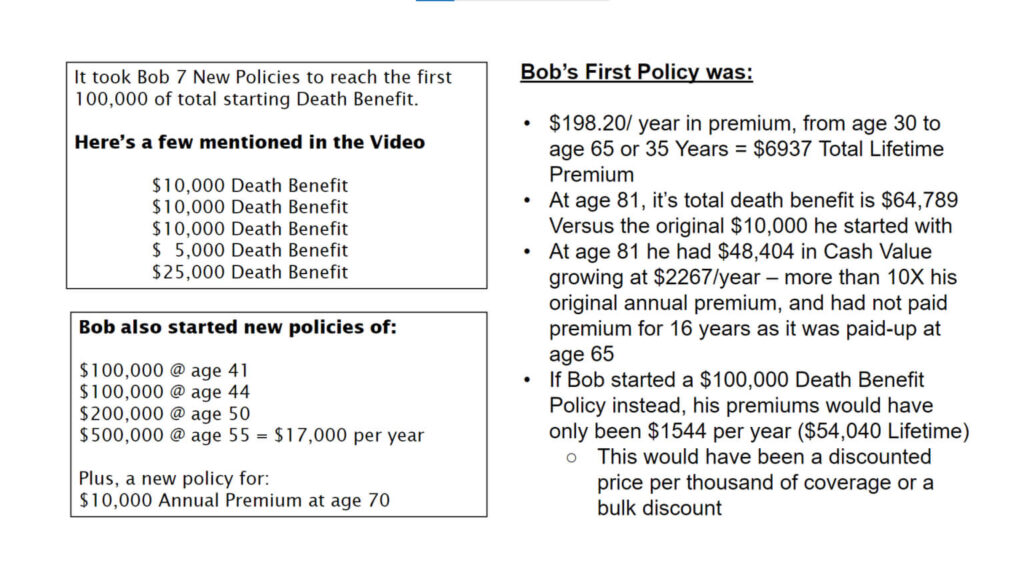

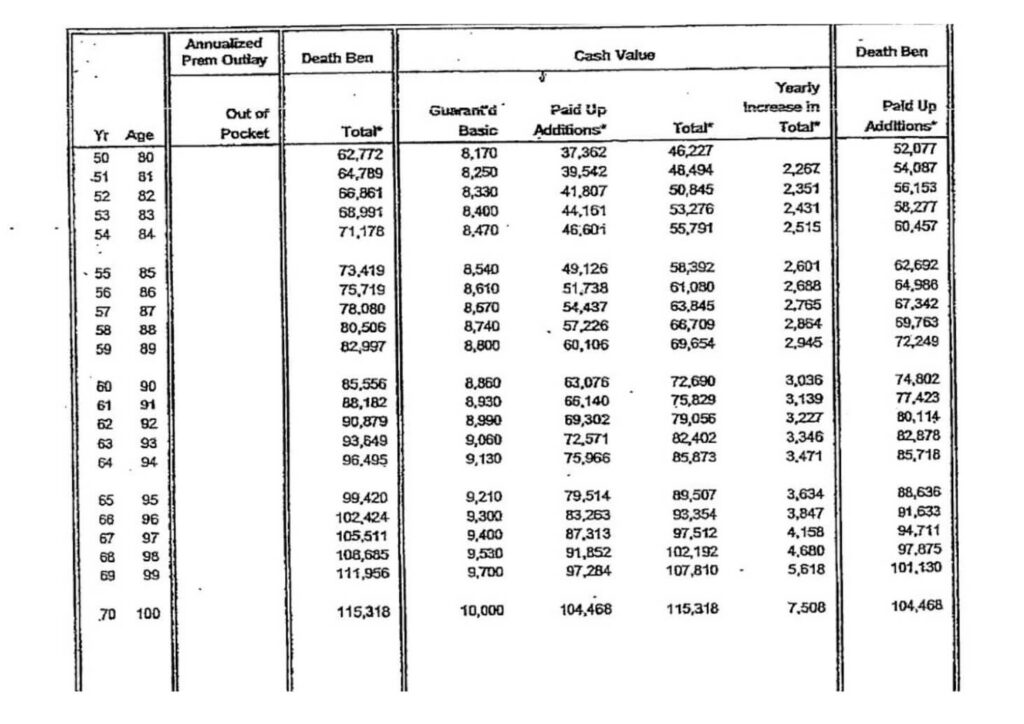

Summary of Bob Shiels Video and first Policy with London Life:

What This Covers

This was an open group discussion and client coaching session reflecting on the Bob Shields video and broader experiences with Infinite Banking. Participants shared personal takeaways, real-life applications of policy loans, and strategic insights around capitalization, debt payoff, and system building.

Why Clients Use It

Reinforces the Infinite Banking mindset through real-world stories

Normalizes taking policy loans as a strategic financial tool

Builds community, inspiration, and deeper learning through peer experience

Encourages creative thinking about how to fund new policies and optimize cash flow

Key Insights by Timestamp

00:00 – Voting for group vs breakout discussion

Participants chose to stay in one group to share stories and reflections on Bob Shields’ message.

01:04 – Manus

Echoes the regret many share: “If I started younger, I would’ve bought more death benefit.”

Encourages not being afraid to capitalize early and often.

02:25– Sean

“If you don’t owe money on your policy, we didn’t sell you enough.”

Excited about stretching with new policies and leveraging loans for growth.

03:33 – Carrie

Used policy loans to pay off credit cards, saving interest and paying herself back.

Building momentum to fund more policies.

04:49– Andrew

References Nelson Nash’s twin case study (Page 45):

One person uses policy loans actively.

The other does not ,and loses out.

“In Infinite Banking, loan is a sexy word.”

06:23 – Dan

Late starter who saw Bob Shields live.

Message that stuck: Even a small policy can outperform a lifetime of inaction.

“Don’t be afraid to capitalize”, especially when time is short.

08:20 – Mike (business owner)

Policies stabilized cash flow in an unpredictable industry.

Has taken over 50 policy loans to manage gaps between income cycles.

If not for policies, “we would’ve been out of business five years ago.”

14:57 – Ken

Exploring insuring more lives after reaching personal limits.

Realized budgeting within policy loans creates financial flexibility.

Sees himself financing family farm operations.

18:00 – Richard

Echoes Nelson: Only invest in what you know.

Best investment is often in yourself or your business.

Policy loans can help you identify and seize the right opportunities.

20:43 – Q&A: Using policy loans to fund new policies?

Yes, if you plan not to “steal the peas” (i.e., repay responsibly).

Balance is key. Do not overextend liquidity.

23:15 – Richard shares personal strategy

Uses loans to rapidly increase death benefit while covering real needs like taxes.

Example: Turned $40K payment into $160K+ in tax-free death benefit.

Focus is long-term: waiting for windfalls to repay loans.

26:47 – Mike (cell tower idea)

Considering starting a policy with unexpected lease income.

Great example of redirecting new cash flow into the system.

29:12 – Shelley

Uses four policies to fund business and daily life.

Pays bills with credit cards, pays those off with policy loans.

Recently used a financial gift to further capitalize.

“If I can do it, anyone can.”

33:52 – Jose

Pays for everyday expenses, even food via policy loans.

“I live by loans. I’m poor but with a fat IBC policy.”

35:29 – Sandy

Realizing she could use loans to cover her mortgage and feed the system.

Considering switching from biweekly to monthly payments for better flow.

Receives coaching encouragement to test her idea and adjust as needed.

39:38 – Curtis (mortgage expert)

Yes, clients can often switch payment frequency.

Some recover significant cash flow from switching accelerated payment plans.

That cash flow can be redirected into new policies and protection.

Core Takeaways

Policy loans are not debt. They are tools for growth, freedom, and control.

Real clients are using Infinite Banking to fund businesses, pay off debt, manage volatility, and create generational systems.

The community element of learning from others accelerates understanding and confidence.

Capitalization and cash flow are the levers that unlock your IBC system’s full power.